Marketing Guides

Campaigns & Execution

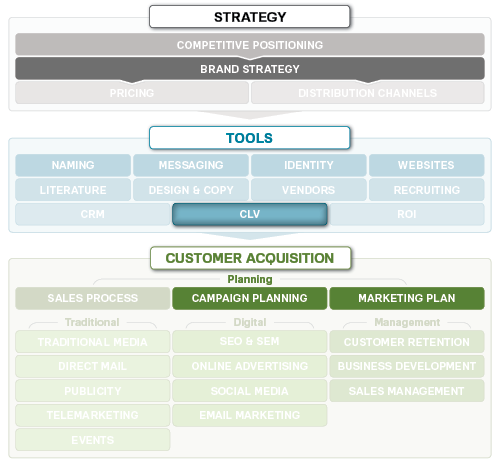

How to Calculate Customer Lifetime Value

Customer lifetime value (CLV) is the amount of profit a customer delivers to your company for as long as the customer is buying from you. It’s typically calculated as the net present value (the value in today’s dollars) of the profit you’ll earn from all of a customer’s purchases over time.

When you understand how to calculate customer lifetime value, you have an extremely powerful tool that helps with:

- Acquisition: You’ll have a better understanding of what you can spend to acquire customers.

- Targeting: You’ll know which customer segment delivers the most profit to your company and you can focus more marketing efforts toward that segment.

- Return on investment: By using CLV in your ROI calculations for marketing campaigns, you’ll have a much more accurate measure of campaign performance.

- Customer retention: You can determine how much you can spend to profitably retain customers.

- Single-customer profitability: You can calculate the profitability of an individual customer.

Using customer lifetime value calculations becomes more important as your marketing budget rises and your customer base grows. Yet even an early-stage company can benefit by using simple CLV estimates.

| Best Case | Neutral Case | Worst Case |

|---|---|---|

| You know how much an average customer in each of your segments is worth to you.

You focus your acquisition efforts on your most valuable segments, and you know how much you can spend to profitably retain your customers. |

You have an idea of who your most valuable customers are, but you’re not really sure how much you should spend to acquire or retain them.

Your ROI measurements for your marketing campaigns are probably very general, though still helpful. |

You don’t know how to calculate customer lifetime value, so you don’t know how much a customer is worth or how much you should spend on acquisition or retention.

You’re not sure what your marketing budget should be, and you’re not confident in the quality of the investments you’re making. |

Not Sure How to Calculate Customer Lifetime Value?

Access detailed step-by-step plans in our new marketing website.

It’s free to use

Here’s How to Calculate Customer Lifetime Value

Before you begin

You’ll want to look at your customer lifetime value for different groups of customers, so make sure you’ve defined your segments. CLV is a valuable tool to improve your marketing campaigns and budget; it’s also used when you’re working on customer retention and ROI.

Confirm your formulas

There are several figures you’ll need for your CLV calculations:

- Cost of goods sold (COGS): the cost to physically produce a product or service

- Gross profit: the difference between the price of your product and the COGS

Companies calculate these figures differently, so your first step is to confirm the formulas your company uses.

Determine your customer segments

The CLV calculation is most valuable when you measure it by customer segment – similar groups of customers who use your products/services in a similar way.

For each segment, determine how long an average customer stays with you — the “lifetime”

Look at your customers’ buying patterns and calculate the total number of purchases they make and the time between those purchases.

Calculate your customer lifetime value for each segment

Once you know the average lifetime, you’ll calculate

- The total profit you earn on all of their purchases

- The probability that they’ll make successive purchases

- The value of future revenue if you had the cash today

Use CLV to improve your acquisition and retention marketing

Once you have a CLV for each customer segment, you can

- Set a maximum budget to acquire a particular type of customer.

- Calculate whether a particular deal will be profitable.

- Look at current customers who haven’t purchased according to the pattern you estimated in the calculation. They’re more likely to defect, so launch a retention campaign to those customers.

- Plug it into your ROI projections. It’s more accurate to calculate your return on a campaign when you use the total profit the customer represents over time, not just the profit you earn on the first sale.

After Calculating Customer Lifetime Value

Keep applying CLV and using it in your marketing strategies and plans. When you use CLV and ROI in all of your campaigns, you have powerful tools to help you grow your company’s revenue and profit.

CUSTOMER LIFETIME VALUE CALCULATORS / MARKETING PLANS / PROJECT MANAGEMENT

EVERYTHING YOU NEED FOR YOUR MARKETING PROJECT